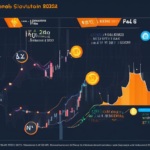

As of October 12, 2024, the cryptocurrency landscape is rife with speculation and potential opportunities as bitcoin continues to dominate discussions within both investor circles and the general public. Recent data indicates that the current price of Bitcoin hovers around $74,976, reflecting a generally bullish sentiment among traders. Market analysts predict that throughout October, Bitcoin prices could experience considerable fluctuations, with estimates suggesting a range between $62,775 and $84,713. These forecasts, which project an average trading price of $73,744, highlight the volatile yet compelling nature of the crypto market.

Market Sentiment and Influences

The sentiment in the crypto market is substantially positive, indicated by a notable 77% bullish consensus and a Fear & Greed Index score of 49, categorizing investor sentiment as neutral. This optimism is further fueled by the broader market performance seen in major stock indices, such as the Dow, S&P 500, and Nasdaq, which recently reported gains primarily driven by strong earnings from major financial institutions. Such positive corporate outcomes may encourage further investment in both traditional and cryptocurrency markets, presenting unique opportunities for savvy investors.

Meanwhile, the economic outlook remains precarious, with inflation continuing to be a concern despite the positive stock market performance. The Federal Reserve’s hinted potential for additional interest rate cuts could serve to support recently observed stock gains and impact overall economic conditions. As the Fed continues to navigate these waters, investors and analysts remain attentive to the implications such decisions may have on the broader financial markets, including cryptocurrencies.

Impact on Mortgages and Financial Products

While there has not been specific news regarding home mortgage loans in recent days, it is essential to understand the interconnectedness of all these financial factors. Any changes in interest rates, particularly reductions by the Federal Reserve, can dramatically affect mortgage affordability. Lower interest rates could enable potential homebuyers to secure more favorable loan terms, boosting the housing market. These factors, combined with ongoing inflation concerns, create a complex environment for prospective homeowners and investors alike.

Furthermore, as we move forward into the latter part of the year, the interaction between crypto assets and traditional financial products becomes increasingly relevant. Bitcoin’s pricing trajectory, projected to increase by 13.68% to reach $70,258 by October 13, and its anticipated monthly average of around $68,710, illustrates the potential for significant return on investment for those willing to participate in the market. However, the volatility and unpredictability inherent to cryptocurrencies necessitate a measured approach.

In summary, the current landscape of Bitcoin and the broader economic environment presents both challenges and opportunities. As we observe the continual evolution of market conditions, it is vital for investors to remain informed. The interplay between economic indicators, interest rates, and crypto valuations will undoubtedly shape the financial landscape as we head toward the end of 2024, making it an exciting time for market participants.